Chatsworth Bankruptcy Attorney

Disaster can take many forms, not least of which is financial. A loss of a job, an accident or a loved one who comes down with a catastrophic illness are all reasons why many people facing financial devastation file bankruptcy. Businesses experiencing hardship because of lawsuits or the collateral consequences of the loss of a major employer in town also seek bankruptcy protection.

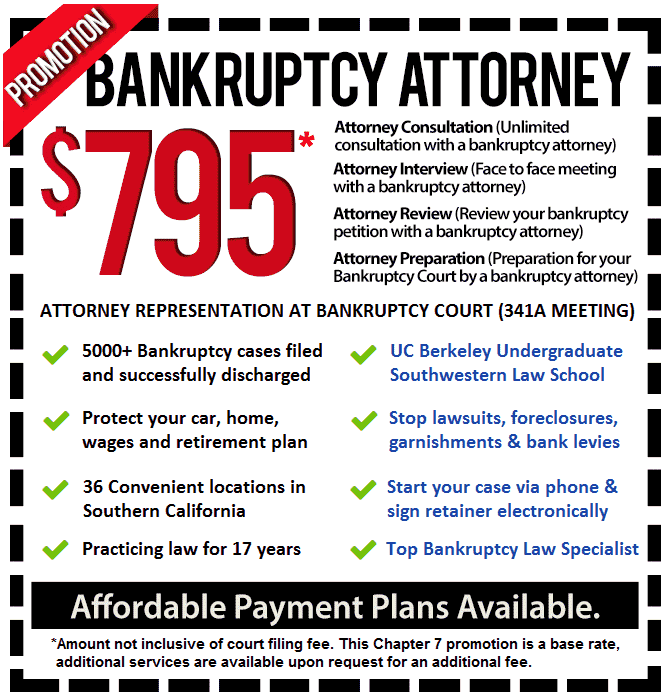

Chatsworth residents and business owners can call a Chatsworth bankruptcy attorney at 888-888-8888 if too much debt is creating discord or an impending loss of assets. A Chatsworth bankruptcy attorney is someone you can consult with to discuss how bankruptcy might be a solution.

A Chatsworth bankruptcy attorney handles all types of bankruptcy for consumers and businesspersons. Consumers can wipe out certain debt in Chapter 7 or repay creditors in a Chapter 13 if certain circumstances dictate it. Businesses can reorganize under Chapter 11 and attempt to regain solvency.

Chapter 7 Bankruptcy

Chapter 7 is a straight bankruptcy where eligible consumers burdened by credit cards, department store bills, medical bills, payday loans and personal loans can have such debts discharged. A Chapter 7 Bankruptcy Lawyer will evaluate your income to see if it meets state criteria. Your assets are also checked by a Chapter 7 Bankruptcy Lawyer to see if certain exemptions apply so you can retain them. If deemed eligible, you will have to complete a debt counseling class before filing, which can be arranged by your Chapter 7 Bankruptcy Lawyer.

A petition is prepared by a Chatsworth bankruptcy attorney with your financial information and transactions for review by a trustee at a 341 Meeting. You and your Chapter 13 Bankruptcy Attorney meet with the trustee to see if you have assets that may be surrendered or other issues.

In most cases, the trustee will grant you a discharge of those debts about 90 days after the meeting. Your Chatsworth bankruptcy lawyer will advise you on how to handle some of your secured debt to your advantage.

Chapter 13 bankruptcy

If your debt exceeds certain limits or you would lose valuable assets in Chapter 7, as confirmed by a Chapter 13 Bankruptcy Attorney, then you can file under Chapter 13. This is a repayment plan drafted by a Chapter 13 Bankruptcy Attorney primarily for secured and priority creditors.

Chatsworth residents in danger of foreclosure or an auto repossession can include these arrearages as well as those from student loans, alimony or child support in the plan. A Chapter 13 Bankruptcy Attorney can determine if the repayment plan is a feasible one considering your disposable income.

Chatsworth sole proprietors may include business debt in the repayment plan so long as they personally guaranteed the debt.

Your Chapter 13 Bankruptcy Attorney prepares basically the same petition as in a Chapter 7 but filers retain all assets. You make a single monthly payment to a trustee over a 3 or 5 year period who distributes it to your creditors. At the plan’s conclusion, any unpaid unsecured debt is wiped out.

Chapter 11 Bankruptcy

Businesses experiencing severe hardship can elect to file for reorganization under Chapter 11. This is a more complicated version of a Chapter 13. A Chapter 11 Bankruptcy Lawyer must present a reorganization plan that classifies creditors, advises them on how much of their debt is to be repaid and outlines the plan for restructuring the business back to profitable status.

Certain creditors and equity holders vote on confirming the plan. If confirmed, the Chatsoworth business may continue its operations but its reorganization strategies must first be court approved if it affects the business in a material way. Your Chapter 11 Bankruptcy Lawyer will deal with creditor issues and file progress reports with the court.

Individuals can also file under Chapter 11 but should check with a Chatsworth bankruptcy lawyer on their obligations and expectations.

Call a Chatsworth bankruptcy lawyer at 888-754-9877 for additional information on how bankruptcy could avert financial disaster for you or your business.